Let’s talk about the most important financial ratios for a company?

Conteúdo

How well is your business doing?

Do you think you can be sure about the answer to this question without monitoring the main financial KPIs (Key Performance Indicators) in your company?

Financial KPIs are used to measure a company’s performance and financial health.

If you do not monitor these ratios, it is not viable to make plans.

Measuring performance is vital in all business areas since the numbers are essential to make better decisions.

Financial ratios are determined by looking at the following financial statements of a company:

- Balance sheets

- Income Statement

- Statement of Cash Flows

Those are clear representations of a company’s situation and financial performance, and they aim to 3 things:

- to diagnose past performances

- to determine parameters and help to establish goals for a financial plan

- to be the basis for monitoring and executing the financial plan

If you need help to evaluate your business situation, you can hire a specialized company, or you can use a software for corporate financial management. The software will facilitate how you plan and manage your company.

5 categories for the most important financial ratios

Financial KPIs can fit into 5 categories:

- Liquidity ratios: capability to fulfill obligations in the short term

- Debt ratios: long term level of debt used to generate profit

- Profitability ratios: measure a company’s profit concerning its assets

- Market ratios: evaluate a company’s value in relation to share prices

- Activity ratios: measure period of cash inflow and outflow.

By analyzing theses ratios correctly, a company can identify if there is a need for improvement. This means that analyzing financial KPIs is gathering information to understand the present situation and project the future.

Not using this information would be the same as travelling without a final destination.

The importance of financial reports: how to evaluate a company’s financial health

A good financial organization is essential for effective management. Thus, information regarding finances must be presented clearly.

Data presented in reports must show financial KPIs that are useful for decision making – decisions that may often be done quickly.

They should help to evaluate a company’s financial health. Therefore, even though long reports have thorough analysis, they may not help.

Modern management requires that data is synthesized and organized in a way that allows quick and efficient analysis.

After all, what are financial KPIs if not a synthetic way to quickly analyze a company’s financial health?

Organizations that adopt this lean model, using only the most important financial ratios to analyze a company’s situation, can consider themselves in competitive advantage. They use data as a tool to facilitate decision making.

It should be highlighted that this method can be used by any company, regardless of its size and segment. We will present below how financial KPIs can demonstrate a company’s financial health.

9 most important financial ratios for a company

There are 9 main financial KPIs that are essential for every business, regardless of their size or segment.

They are:

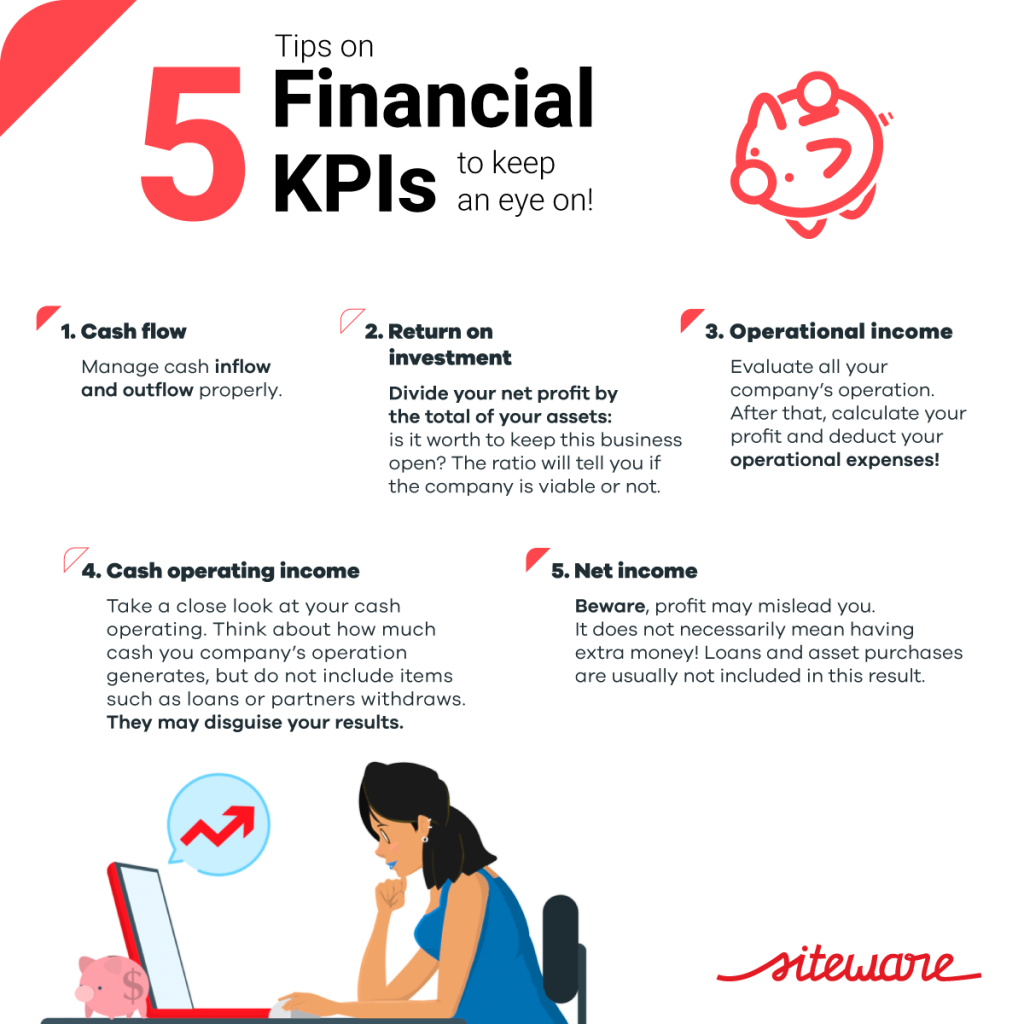

1. Cash flow

Financial ratios shown by cash flow are fundamental.

One of the main reasons why businesses close is the fact that they don’t manage its cash inflow and outflow properly. This is a tool that allows evaluating daily results and project future results.

2. Operational income

This is related to how much cash your business operation takes without taking into consideration loans or partner withdraws.

Operational factors may disguise results. So, in order to have a proper resource planning, it is important to check the health of operation without the influence of items that are not part of your company’s goals.

3. Cash generation

This is the last step of cash flow, and it shows how much money has left or lacked.

A positive cash generation is not necessarily sound. That is why it is important to analyze it together with other ratios.

When a positive result is seen in cash generation, one should ask which future results could be even better. On the contrary, if there is a negative result, one must evaluate management to identify what has caused this result.

As you might have heard… Cash flow is king

4. Operating income

By looking at an Income Statement, it is essential to analyze the operating income.

This indicator evaluates all of a company’s operation. After counting the profits, one should deduct operational costs. That is, the necessary costs to maintain a company functioning. Those are expenses such as rent, telephone, salaries, labor charges, marketing expenses, etc.

This is determined by reducing variable costs, deductible expenses, and operational expenses from the income.

In Income Statement you obtain the result of your competency or the real potential of your business model.

5. Net profit

This is the real profit – something that can also be misleading.

It is the last thing in an Income Statement.

Profit does not take into consideration:

- risks of enterprising

- the opportunity cost of capital employed

- if there is money in cash or not

Profit does not necessarily mean having extra money in the company, especially because Income Statement do not consider loans, asset purchase, unsold stock and partner withdraw.

Profit can be an illusion, so be careful about it!

6. Point balance

This is how much you need to profit in order to pay all of a company’s expenses, such as variable and fixed costs.

It is an excellent ratio to guide you in your revenue goals and can be used for comparisons with profit statements and statement of cash flow.

Monitor your goals, identify possible setbacks, and create corrective actions to achieve results with this free spreadsheet. Download it here!

It is a basic ratio to analyze any business.

Ideally, your company should pass the point balance because from that on it starts to be profitable.

7. Return on investment

This may be the most important financial ratio for a company.

It is easily calculated: net income is divided by total assets.

Is it worth to keep this business open?

That’s the question this ratio will answer, if it is calculated correctly and with trustworthy numbers.

8. Company’s value

What is the value of your business?

Is the total amount of your assets the same as the value of your business?

What about the intangible value of your brand?

Think about it… how many properties do hotels and resorts such as Accor and Marriott have?

Certainly, much more than AirBnB, which owns not even a single hotel room. However, the last one is considered the largest accommodation network in the world.

So what has more value: tangible assets or an idea that generates a lot of money?

9. Budgetary control

Corporate budget is one of the most important financial ratio for a company to predict the revenue and expenses in a certain period. This way, it is possible to allocate funds for what is intended to do.

Therefore, this is an important management tool as it allows monitoring goals and adjusting the use of funds. If there is any inconsistency between what was predicted and what was actually done, it also allows going back to the initial plan.

Financial KPIs presented above are relatively easy to be calculated. Most importantly, a company should have a system that organizes these data and presents them in a way that facilitates the analysis of a company’s financial health.

To this end, a manager should understand what financial ratios are and how to use them in order to keep the good financial health of the company.

Without monitoring ratios, there is no way to manage a business in any area.

Siteware has developed STRATWs ONE, a software for management by results, that helps you to monitor on your business’ performance in real-time, with control panels and KPIs.

Revolutionize the management of your company with STRATWs One